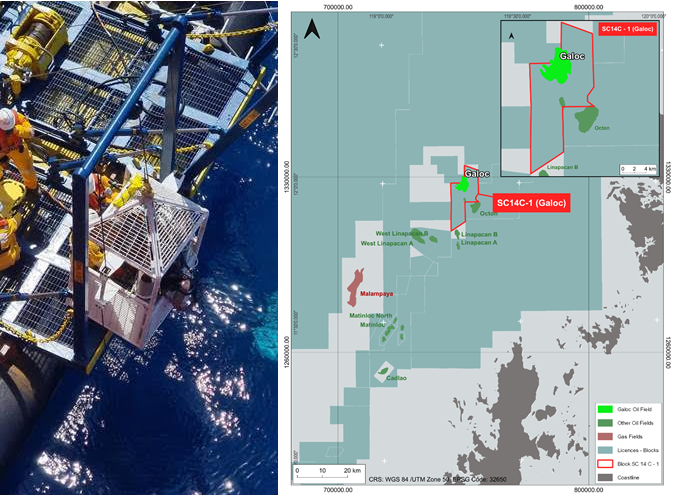

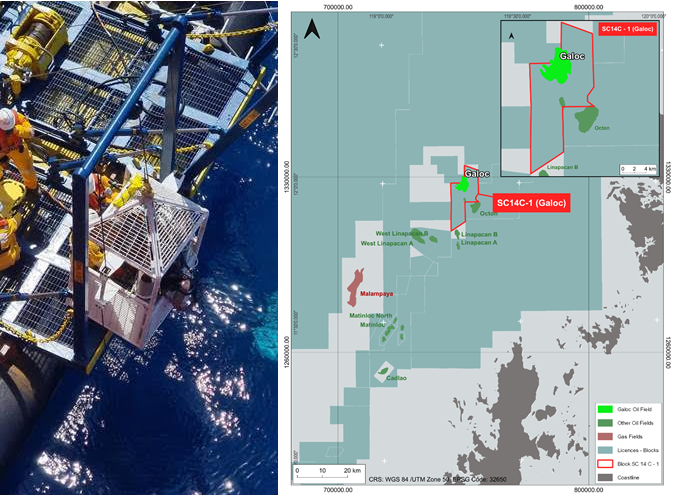

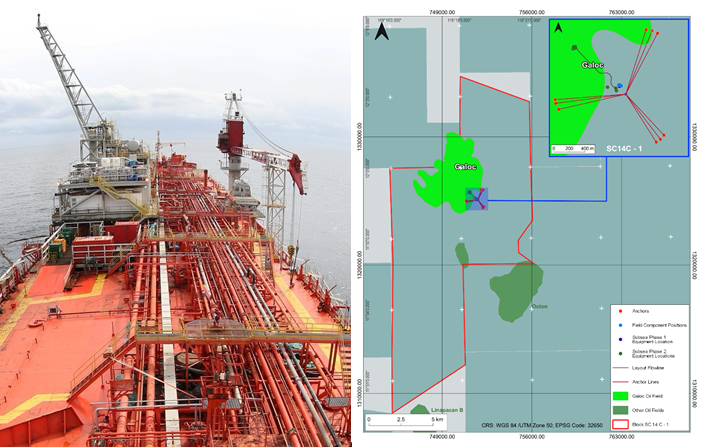

Service Contract 14C (Galoc Field) is located 60km northwest off Palawan Island, offshore of the Republic of the Philippines. Matahio Energy holds a 79% operating interest via its wholly owned local entity NPG, alongside domestic partners.

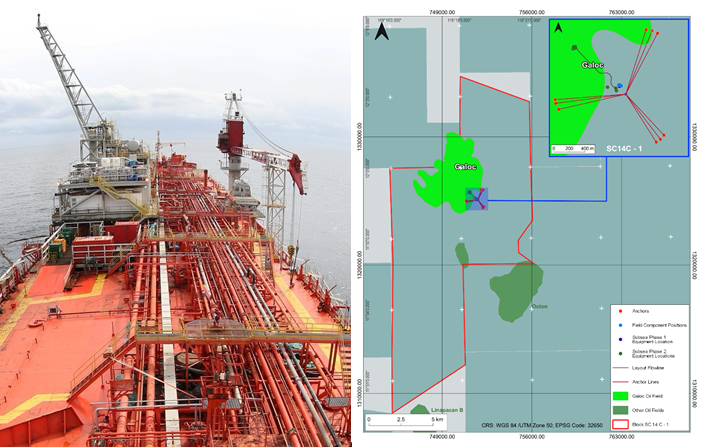

Galoc has been in production since 2008 and recently passed 24 MMstb recovered. The field produces 1,500bopd (Gross) via four subsea wells tied back to a Floating Production, Storage and Offloading (FPSO) vessel “Intrepid Balanghai”, which is also owned by Matahio. Since taking over as Operator in late 2018, the Matahio team have halved the asset’s operating costs. Consequently, the field is now expected to produce into the late 2020’s.

The FPSO and subsea facilities are managed by THREE60 Energy under a Life-of-Field Operations and Maintenance contract, supported by NPG’s operations team in Manila and technical experts in Singapore and Kuala Lumpur.

Matahio Energy are the 100% owner of the FPSO Intrepid Balanghai, a a Panama-flagged vessel with IMO 8009569 and classified by the American Bureau of Shipping (ABS). Key technical specifications include:

The vessel is currently located at the SC14C Galoc Field, offshore Palawan in the Republic of the Philippines. The vessel is operated in partnership with THREE60 Energy as Operations and Maintenance contractor. Matahio are actively seeking re-deployment opportunities for the FPSO, with a particular focus on Philippines opportunities.

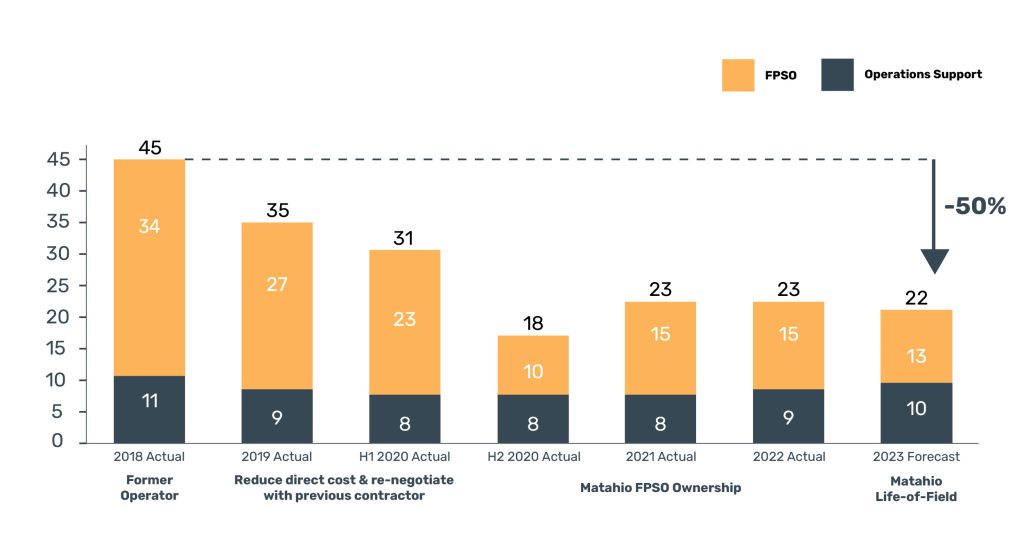

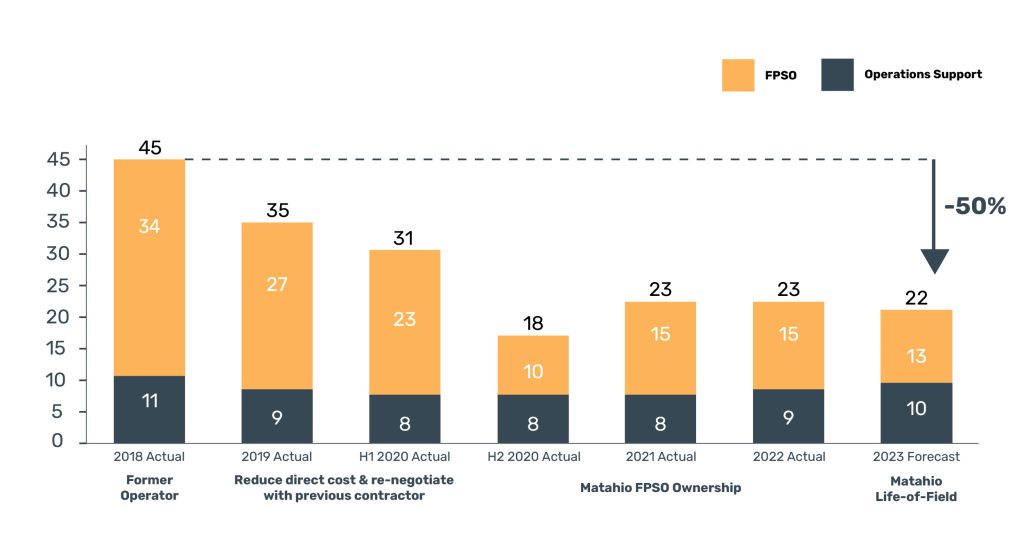

Matahio’s management team has successfully operated an offshore Philippines field since late 2018. At this time, the field has been producing for ten years and had entered late life. Through the process of operatorship transition, the team was able to target several operational cost optimizations and contract enhancements, resulting in a 20% reduction in OPEX in the first year.

However, the 2020 oil price challenge prompted the need for a fundamental – and sustainable – change in the operating model in addition to short-term – but ultimately unsustainable – cost savings. The Matahio Management Team undertook the following structural changes to the asset’s cost structure:

The above has, collectively, significantly lowered lifting costs by >50% and has introduced several further levers to lower these even further in the event the oil price reduces substantially (as it did in 2020). Ultimately, the economic field life now has the potential to be extended well beyond current service contract expiry.

The company also maintained a strong working relationship with the Philippines Department of Energy, receiving constant support to maximize the field’s potential.

Matahio’s ethos has been decarbonising from within its operations as the first step to reducing its overall carbon footprint. This is the primary mechanism by which Matahio contributes to the energy transition agenda as a responsible and sustainable oil and gas producer.

This energy transition work has been integrated into a companywide ESG plan.

By identifying and maturing decarbonisation opportunities, Matahio has unlocked several greenhouse gas (GHG) reduction initiatives by forming and leveraging meaningful partnerships with varied objectives.

Service Contract 14C (Galoc Field) is located 60km northwest off Palawan Island, offshore of the Republic of the Philippines. Matahio Energy holds a 79% operating interest via its wholly owned local entity NPG, alongside domestic partners.

Galoc has been in production since 2008 and recently passed 24 MMstb recovered. The field produces 1,500bopd (Gross) via four subsea wells tied back to a Floating Production, Storage and Offloading (FPSO) vessel “Intrepid Balanghai”, which is also owned by Matahio. Since taking over as Operator in late 2018, the Matahio team have halved the asset’s operating costs. Consequently, the field is now expected to produce into the late 2020’s.

The FPSO and subsea facilities are managed by THREE60 Energy under a Life-of-Field Operations and Maintenance contract, supported by NPG’s operations team in Manila and technical experts in Singapore and Kuala Lumpur.

Matahio Energy are the 100% owner of the FPSO Intrepid Balanghai, a a Panama-flagged vessel with IMO 8009569 and classified by the American Bureau of Shipping (ABS). Key technical specifications include:

The vessel is currently located at the SC14C Galoc Field, offshore Palawan in the Republic of the Philippines. The vessel is operated in partnership with THREE60 Energy as Operations and Maintenance contractor. Matahio are actively seeking re-deployment opportunities for the FPSO, with a particular focus on Philippines opportunities.

Matahio’s management team has successfully operated an offshore Philippines field since late 2018. At this time, the field has been producing for ten years and had entered late life. Through the process of operatorship transition, the team was able to target several operational cost optimizations and contract enhancements, resulting in a 20% reduction in OPEX in the first year.

However, the 2020 oil price challenge prompted the need for a fundamental – and sustainable – change in the operating model in addition to short-term – but ultimately unsustainable – cost savings. The Matahio Management Team undertook the following structural changes to the asset’s cost structure:

The above has, collectively, significantly lowered lifting costs by >50% and has introduced several further levers to lower these even further in the event the oil price reduces substantially (as it did in 2020). Ultimately, the economic field life now has the potential to be extended well beyond current service contract expiry.

The company also maintained a strong working relationship with the Philippines Department of Energy, receiving constant support to maximize the field’s potential.

Matahio’s ethos has been decarbonising from within its operations as the first step to reducing its overall carbon footprint. This is the primary mechanism by which Matahio contributes to the energy transition agenda as a responsible and sustainable oil and gas producer.

This energy transition work has been integrated into a companywide ESG plan.

By identifying and maturing decarbonisation opportunities, Matahio has unlocked several greenhouse gas (GHG) reduction initiatives by forming and leveraging meaningful partnerships with varied objectives.