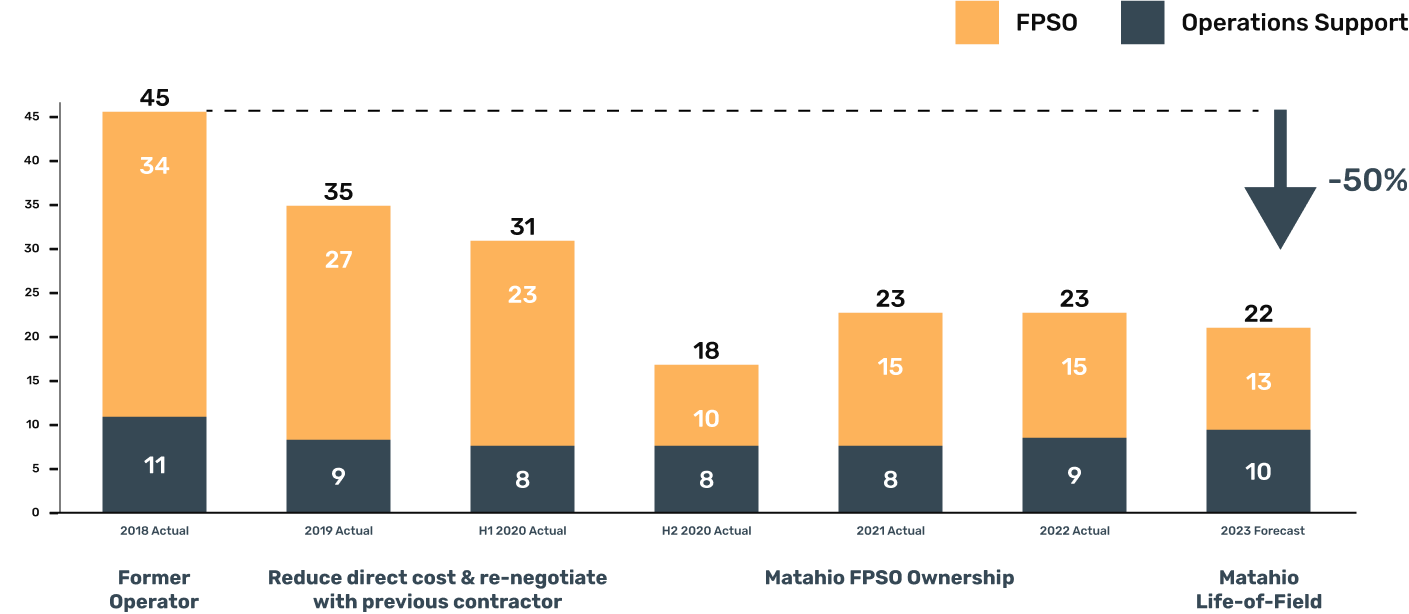

Innovative cost restructuring leads to a 50% reduction in lifting costs at our Galoc Field

In 2018, Matahio's management team assumed responsibility for a late-life field 60km off the coast of Palawan Island in the Philippines. The SC14C Galoc Field had been producing for ten years and sorely needed a fresh perspective. Within just the first year, our team reduced operational expenses by 20% — but this was only the beginning.

The 2020 oil crisis marked a new opportunity for change. The Matahio management team undertook the following structural changes to the asset's operating model and cost structure:

O1

Took control of critical infrastructure

The Operator acquired the FPSO and leased it back to the joint venture at a significantly reduced bareboat charter rate. Importantly, Matahio now has direct control of this vital piece of infrastructure, including the freedom to execute brownfield projects, the first of which is targeting a 20% reduction in greenhouse gas emissions.

O2

Formed a crucial partnership

Matahio works closely with THREE60 Energy for the operation and maintenance of the FPSO. The nature of this partnership drives long-term cost optimisation in line with declining production rates and/or oil fluctuations, balanced with ensuring asset integrity and reliability.

O3

Aligned with critical service providers

Leveraging strong relationships with local contractors, long term agreements were enhanced to include reduced rates when the oil price is low, but shared upside when the oil price is high.

Through these actions we have halved lifting costs and introduced several further levers to lower these even further in the event the oil price reduces substantially. Ultimately, the economic field life now has the potential to be extended well beyond current service contract expiry.